The $3 Billion Story of India's Toy Industry

11 Jan 2025

🎉🏪 Who can resist the allure of a toy store?

From the moment we were kids, those shelves overflowing with different objects of vibrant colour and fantastical creatures held an irresistible pull. That magic, it seems, hasn't faded. Today, the Indian toy industry is experiencing a remarkable surge, fuelled by a potent mix of nostalgia, innovation, and a growing emphasis on quality playtime.

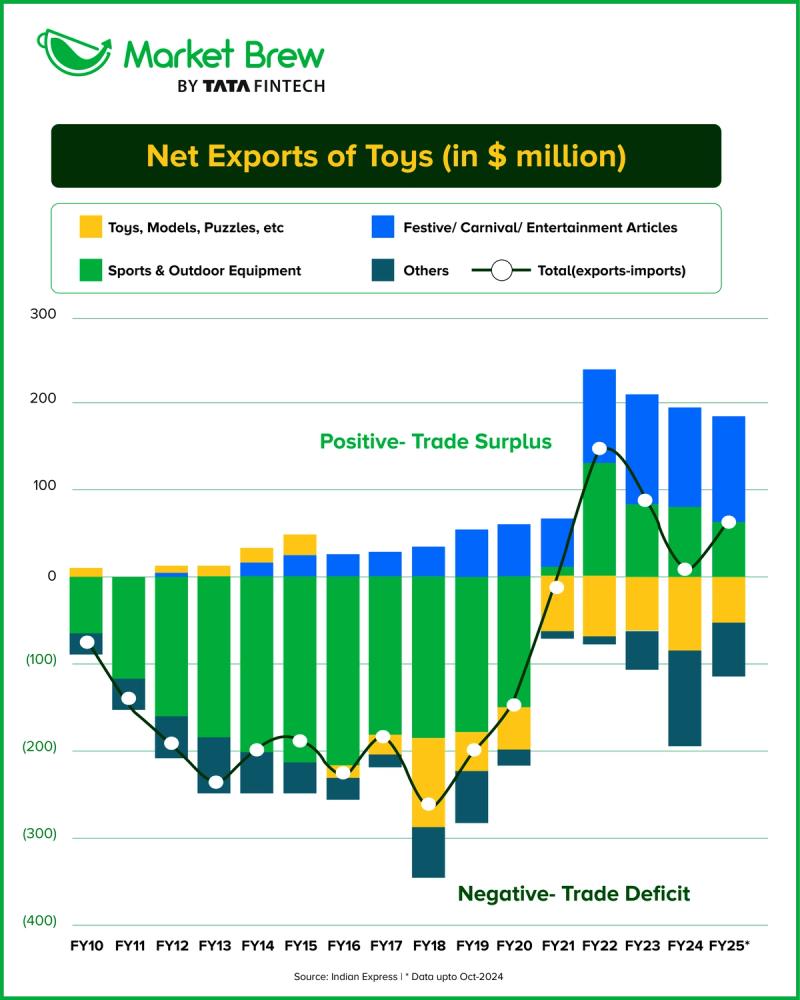

India’s toy industry is levelling up. Once a net importer of toys, the country has made a surprising turnaround. From exporting just $134 million worth of toys, sports gear, and festive items in FY10 to hitting $523 million in FY24, India has come a long way. But what’s driving this shift?

Let’s dive in.

🧸🪀 The Toy World of India

India’s play and recreation sector can be split into three main parts:

- Toys, models, and puzzles – Think dolls, figurines, playing cards, and electronic toys.

- Festive and carnival articles – Magical props and festive decor.

- Sports and outdoor equipment – Gear like balls, racquets, and more.

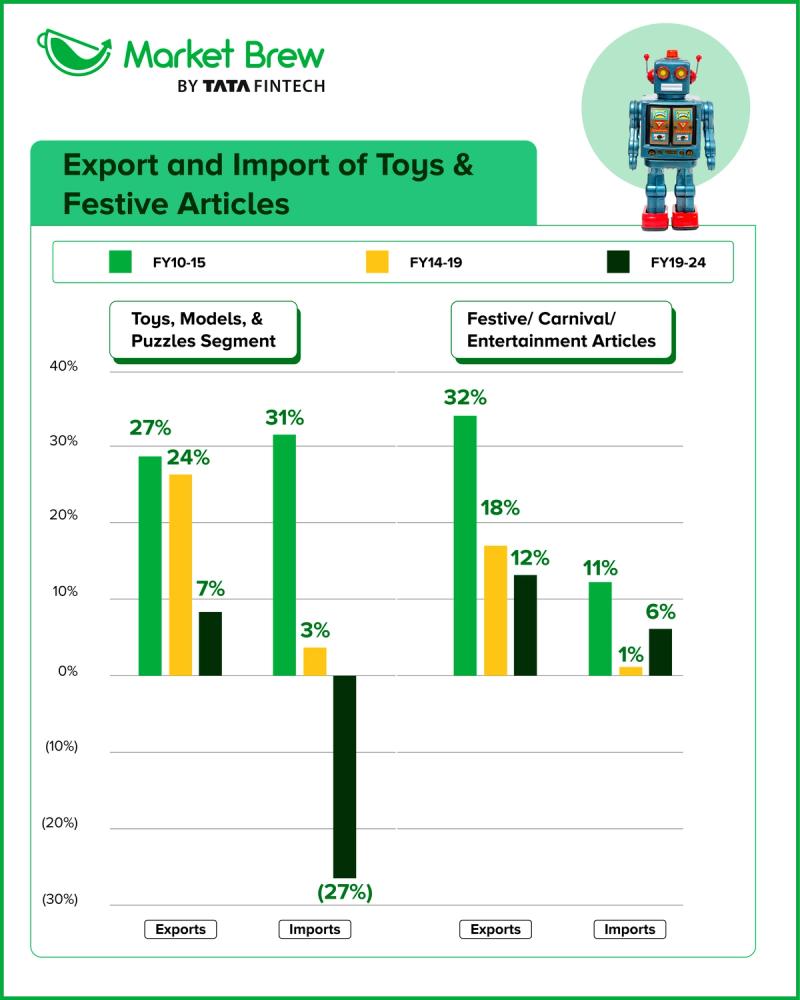

In FY10, sports equipment held a dominant 70% share in the export market. By FY24, though, the landscape changed. Sports gear now contributes just 37%, while toys have jumped to 29%, and festive articles took 25%.

What’s more interesting?

Exports outpaced imports starting in FY21. This marked India’s transition from being a net importer to a net exporter. How did this happen? Let’s break it down.

📊🚢 How did imports fall?

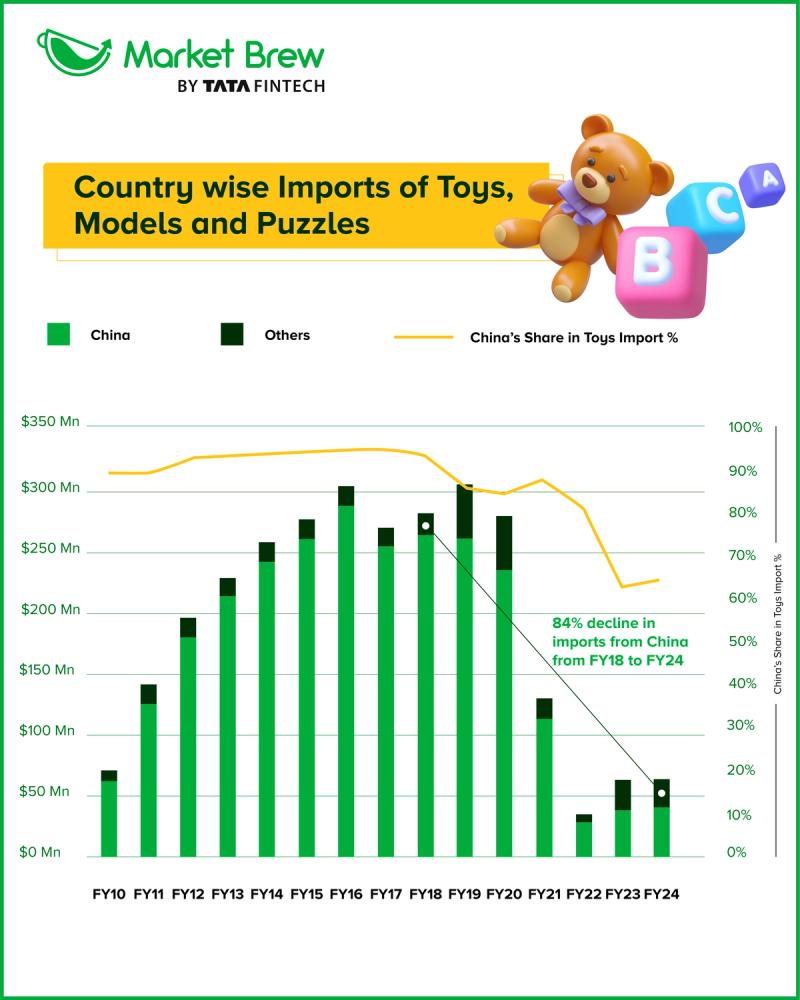

Well, if you think that the imports fell because India started to export more, then you are wrong. India’s recipe for being a net exporter isn’t about selling more; unfortunately, it’s about buying less. Since FY18/FY19, India has been cutting down on imports, especially from China. It’s doing this by making it difficult to import.

Between FY20 and FY24, India shot up tariffs on toys—from 20% to 70%. Then came the Quality Control Order (QCO) in January 2021. It made safety standards stricter, making it difficult to produce or import any substandard toy in India.

These steps had an immediate effect on the trade balance—but only on the toys, models, and puzzles segment. As a result, imports dropped by 27% between FY19 and FY24, while exports increased by a mere 7%—down from over 24% growth in the previous five-year period. This was mostly due to one player—China.

📉 Fall in Trade with China

China used to be India's preferred supplier for toys, but the additional tariffs made it feel the impact of these measures. In FY18, India imported $263 million worth of toys, models, and puzzles from China—93% of all imports in this segment. By FY24, this number fell to $42 million, just 64%.

📊 What Else is Aiding India?

The Indian government stepped up with a National Action Plan for Toys in 2020 to boost local manufacturing and incentivise toy and handicraft producers. It talks about four broad themes: promoting trade and investment, designing and manufacturing toys in India, promoting indigenous toys, and toys as learning resources.

Free trade agreements (FTAs) with countries like the UAE and Australia also helped. Zero-duty exports to these markets gave Indian toy makers a big boost.

🏭 Where Are They Produced?

Regions such as NCR, Maharashtra, Karnataka, Tamil Nadu, and central states host the magic. India’s domestic toy manufacturing market is quite small and unorganised. Most of these are small and medium-sized businesses (around 4,000 in total). Only 10% of the market belongs to the organised sector. While the big players are few, some startups are trying to gain ground.

New ideas are being introduced by startups such as PlayShifu, Kitsons, Shumee Toys, The Elefant, DICE Toy Labs, and Nesta Toys. Playgro is setting up one of India’s largest toy manufacturing facilities in Ujjain, Madhya Pradesh. Aequs, a Belagavi-based contract manufacturer for global brands, is establishing a 400-acre toy cluster in Koppal, north Karnataka. The company already serves Hasbro, Spin Master, and Chicco.

The estimated value of India's toy industry is $3 billion, a small portion of the $108 billion global market. But slowly, the sector is getting the attention it deserves. Last year, BIS granted 1,454 licenses to domestic manufacturers and 36 licenses to foreign manufacturers for the safety of toys.

🥊 Challenges across the landscape

India’s share in the global toy export market is as low as 0.3% in 2022, compared to China’s staggering 80%. There are two main problems: scaling and quality.

“Much of India’s local toy production remains outdated, operating with decades-old methods,” said Ajay Shrivastava, founder of think tank GTRI.

However, the landscape is shifting. Vijendra Babu, Managing Director of Micro Plastics, says, “Indian toy manufacturers are now making investments into new infrastructure, enhancing expertise, and scaling operations to meet evolving market demands.” Efforts like improved safety, quality standards, product innovation, process engineering, and enhanced graphic communication are replacing imports gradually.

📰 The BIS hindrance

While India implemented a lot of policies for maintaining high-quality standards, these also have a negative impact on the small and medium-scale enterprises that operate within the country. One such thing is ‘The Bureau of Indian Standards’ (BIS) approval.

India has made it mandatory for sellers to get BIS approval before selling toys there. The implementation primarily aimed to enhance standards and limit the import of substandard toys from China. However, this has also created hurdles for micro, small, and medium enterprises (MSMEs). Out of approximately 6,000 toy manufacturing units in India, only 1,500 have obtained a BIS license. Not only this, major foreign brands like Mattel’s Hot Wheels were not able to sell their iconic scale models in India due to a lack of a BIS certification.

This suggests that a significant number of smaller businesses are struggling to meet the requirements for BIS certification. The Toy Association of India (TAI) believes that BIS rules should be relaxed to better support these MSMEs.

💸 Opportunities in the Indian toys market

But there’s a lot to do when it comes to electronic toys. Fixing that is important as it dominates global trade. It’s valued at around $15 billion globally, according to the 2024 GTRI report, and it is expected to grow even faster due to rapid urbanisation and the decline of outdoor play.

Nilay Verma, Hasbro’s country manager, believes that there’s a huge gap in the type of premium toys and games, like animatronic toys, high-end collectibles, strategy board games, and intricately designed action figures with advanced articulation, available in India. Action figures and dolls follow electronic toys globally with a market size of $12 billion, followed by construction toys at $10 billion.

Global giants like Mattel, Hasbro, and Lego are on the lookout for alternative manufacturing hubs. This presents a disruption opportunity.

🏁 The bottomline

But there are two lingering questions. One, will and when would the exports grow higher? We have seen in the past five years that the exports have grown by 7% only from the double-digit growth in earlier phases. Two, will we still be net exporters of toys if we remove tariffs? This will reveal the true nature of the industry, as higher tariffs have been central to the journey of becoming a net exporter.

Read More

Lifestyle

LifestyleMany households in India turn to credit cards or no-cost EMIs to buy big-ticket items. And loans against mutual funds is the new answer.

18 Jan 2025

Lifestyle

LifestyleGlobal giants like Eli Lilly and Novo Nordisk have sparked a revolution with their miracle weight loss drugs. Let’s break down what’s driving this trend today.

04 Jan 2025

Did you find this insightful?

Get Market Brew straight to your mailbox

We will never spam you!

This newsletter/e-mail is meant solely for educational and/or informational purpose of the recipient