✏ DOMS IPO: Here’s How Your Pencil Is Making Money

13 Dec 2023

✏ In a very surprising turn of events, the writing industry of India has made a comeback!

Just a few months ago, Cello World, the famous stationary company, launched its IPO at a premium of 28%. This was followed by the IPO of Flair Writing in November 2023, which also listed at a premium of 66% from its issue price. Another famous stationary manufacturer, DOMS Industries, is now ready to join its peers in the stock market.

The company is launching its IPO on December 13, 2023, and it will remain open until December 15, 2023.

But why are so many writing instrument companies getting listed?

✍ The Re-emergence of Writing

You might be thinking, why are pens and pencils making a comeback on this digital Earth? While the rise of digital technology may convince you otherwise, here’s what the data says:

India’s writing instrument industry is worth ₹13,350 crore in 2023 and is expected to reach a valuation of ₹27,750 crore in the next six years. (As per DOMS Industries DRHP)

This is a growth of 16% while the growth between 2017 and 2023 was just 7%.

What is behind this expansive rise?

- One of the biggest factors is the rise in India’s literacy rate, which has grown from a mere 18.3% in 1951 to 77.7% by 2022.

- With an increasing number of people enrolling into schools, the spotlight on the writing instrument industry has also gained traction.

- As digital devices become more common, researchers are advocating for a return to handwriting. Studies suggest that using pen and paper enhances learning by actively engaging the brain, resulting in better recall.

Result? More revenue, more growth, and more IPOs in the writing industry.

✏ Enter: DOMS

DOMS Industries, the second largest pencil manufacturer, is in the news. And for the right reasons.

It is opening up its IPO on December 13 to raise ₹1,200 crore. The price band for the issue is set at ₹750 to ₹790 per share. The IPO comes at a time when the company registered a revenue of ₹1,211.9 crore in FY23, almost double its FY22 revenue of ₹683.6 crore.

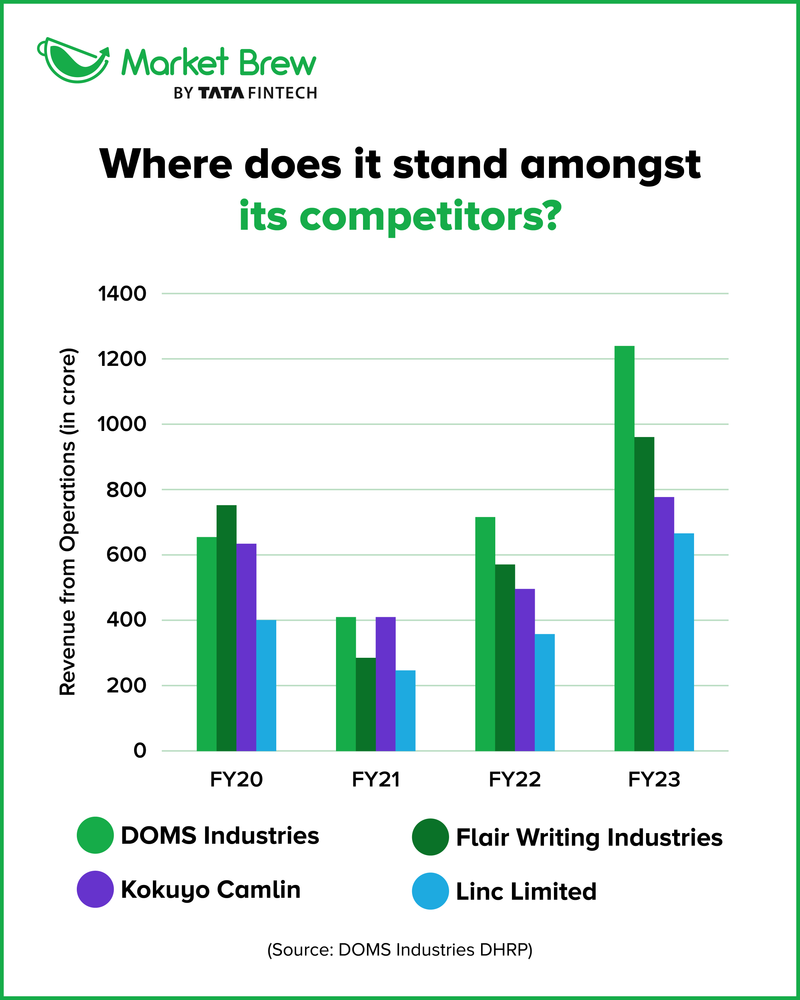

Its competitor, Flair Industries, also registered a high growth of 63% in its revenues in FY23, with Linc Limited growing 37%, and the famous stationary brand, Camlin, growing at more than 50% in the same period.

So how did DOMS achieve this growth?

📊 The Growth Story

Founded in 2005, DOMS industries have been on a steady path of rise since their inception. The key reason? It is strategic growth.

Product Innovation

- Despite being a late entrant in the market, DOMS industries now have a market share of 30–35%.

- The biggest innovation that happened in the company was through pencils. Normally, the lead in pencils is made from graphite and clay. However, DOMS added polymer to the mix, thereby resulting in a much smoother writing experience. This worked well for the company, especially amongst children, who used pencils for at least 4 to 5 hours every day.

- Currently, it is the leading polymer pencil manufacturer globally. DOMS has also worked on improving the grip of pencils. It patented groove technology, using which it placed small indentations on the pencils to improve its grip.

🚚 Supply Meets Distribution

There is another thing DOMS did right: it streamlined its production and distribution system. With over 10 manufacturing facilities, the company has the capacity to produce as many as 5,000 million units across all of its products.

As of 2023, the company’s products are sold in over 3,500 cities and towns in India.

However, the company does not rely solely on domestic sales. DOMS has a partnership with the Italian stationery brand FILA, which has a presence in over 150 countries. Owing to this, in FY23, 20% of the sales came from exports.

After disrupting the industry, DOMS is now raising ₹1,200 crore this month. With this money, the company wants to expand its manufacturing capacity. For this, it has already undertaken a capital expenditure of ₹125.9 crore earlier this year.

The bottomline

The last decade has been a stellar journey for DOMS, marking one of its golden eras. The company has grown at a CAGR of 20% between FY13 and FY22. In essence, DOMS Industries stands at the intersection of tradition and innovation, symbolizing the renaissance of writing instruments.

The only thing left to determine is how disruptive it would be.

Did you find this insightful?

Binge worthy news...

India now has the world's seventh-biggest stock market, overtaking Hong Kong. At the end of November, India's National Stock Exchange was worth $3.989 trillion, surpassing Hong Kong's $3.984 trillion. 🔗

REC has secured a 200-million-euro loan from KfW, a German bank, to improve distribution infrastructure for discoms under the government's revamped distribution sector scheme (RDSS). 🔗

Dixon Technology’s subsidiary, Padget Electronics, has signed a manufacturing deal with Lenovo, a global tech leader. The focus will be on producing a variety of IT hardware, with a particular emphasis on laptops and notebooks. 🔗

Sun Pharma plans to acquire the remaining shares of its US subsidiary, Taro Pharma. It raised its offer price to $43 per share, from the earlier $38 per share. 🔗

Read More

Business

BusinessThe share price of Dixon Technologies has been making new highs for multiple reasons. Learn more about it and the industry here.

14 Dec 2023

Business

BusinessAfter the recent launch of Coca-Cola’s iced tea, the company is venturing into the alcohol market with its new offering, Lemon-Dou. Know more details here.

12 Dec 2023

Get Market Brew straight to your mailbox

We will never spam you!

This newsletter/e-mail is meant solely for educational and/or informational purpose of the recipient